Dead Cat Bounce Finance Meaning

Used particularly in reference to financial issues. From Longman Business Dictionary dead cat bounce ˌdead cat ˈbounce FINANCE an occasion when a share price or stockmarket rises a small amount after a large fall before falling further The market refers to short term recovery in a falling market as a dead cat bounce.

A small rally after a significant decline.

Dead cat bounce finance meaning. Dead Cat bounce is a colloquial phrase which is quite popular in the financial markets. Dead Cat Bounce Definition Example InvestingAnswers. Dead Cat Bounce is a market jargon for a situation where a security read stock or an index experiences a short-lived burst of upward movement in a largely downward trend.

So is the share price improvement a dead cat bounce or the start of something better. The phrase denotes a recovery in the assets price often a sharp one after a prolonged downtrend. As you have seen a dead cat bounce is a continuation pattern more than anything else.

The term implies that the decline will continue and will be sustained. Dead bounce cat is a pricing pattern used by technical analysts and usually identified in hindsight. For example if a stock price drops from 150 to 125 then rises to 130 then drops to 110 the rise is said to be a dead cat bounce.

30 seconds to know What is a dead cat bounce A term often used by technical analysts to explain a small brief recovery in the price of a declining stock or the broader market which is then. DCBs provide an opportunity to short term traders who benefit and are able to make profits from the short rally. In finance a dead cat bounce is a small brief recovery in the price of a declining stock.

Reasons for a dead cat bounce include a clearing of short positions. A dead cat bounce refers to a temporary recovery in a stock price or a temporary market rally after a significant downward trend. The term was coined a long time ago and generally referred to the peculiar behaviour of the price.

A brief and insignificant recovery as of stock prices after a steep decline. Derived from the idea that even a dead cat will bounce if it falls from a great height the phrase which originated on Wall Street is also popularly applied to any case where a subject experiences a brief resurgence during or following a severe decline. It is a temporary rally in the price of a security or an index after a major correction or downward trend.

For example if a stock price drops from 150 to 125 then rises to 130 then drops to 110 the rise is said to be a dead cat bounce. A dead cat bounce is a temporary recovery of asset prices from a prolonged decline or a bear market that is followed by the continuation of the downtrend. A dead cat bounce is a short-term recovery in a declining trend that does not indicate a reversal of the downward trend.

It is common for analysts to predict the temporary recovery of the market using technical and fundamental analytical tools. It is considered a continuation pattern where at first the bounce may appear to be a reversal of the prevailing trend but it is. Either way the upside gets reversed and a new move to the downside follows.

Dead cat bounce A sign that something is healthy or recovering when in fact the thing is already on its way to ruin collapse or stagnation. A dead cat bounce is a small short-lived recovery in the price of a declining security such as a stock. A dead cat bounce is a price pattern used by technical analysts.

Dead Cat Bounce Slang. Based on the figurative notion that a dead cat will still bounce after a large fall. A dead cat bounce is a small and temporary recovery in a financial market following a large fall.

The expression is originated in the UK during the financially turbulent 1980s. Whats the origin of the phrase Dead cat bounce. Dead cat bounce definition.

A temporary increase in the value of shares after there has been a large reduction in their. The term implies that the decline will continue and will be sustained. Definition of dead cat bounce from the Cambridge Business English Dictionary Cambridge University Press Translations of dead cat bounce.

A temporary increase in share prices after there has been a large fall in their value. And little wonder as it can be found most frequently within the context of a bear market or marking both a brief and feeble response of the bulls to a remarkable downside move. Definition of dead-cat bounce.

Dead Cat Bounce What Is It How Can You Profit From It

Dead Cat Bounce What Is It How Can You Profit From It

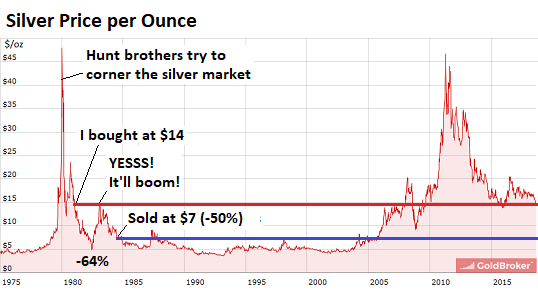

My Theory About Gold And Silver For Long Term Investors Seeking Alpha

My Theory About Gold And Silver For Long Term Investors Seeking Alpha

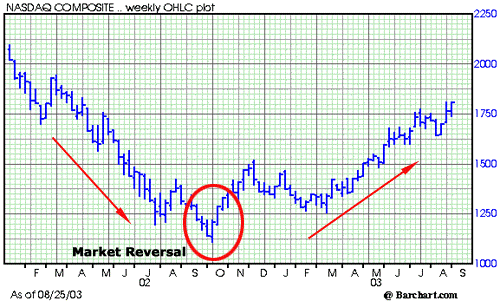

What Is A Dead Cat Bounce How To Trade It

What Is A Dead Cat Bounce How To Trade It

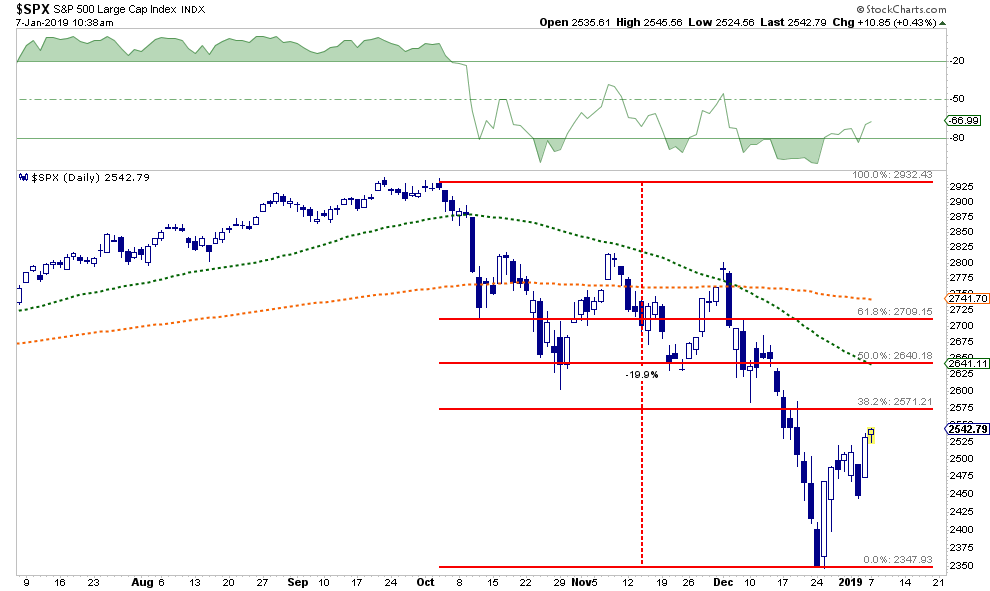

Karsun01 Karsun01 Stocktwits Technical Analysis Smart Money Trading Charts

Karsun01 Karsun01 Stocktwits Technical Analysis Smart Money Trading Charts

Dead Cat Bounce Or Real Rally Investorplace

Dead Cat Bounce Or Real Rally Investorplace

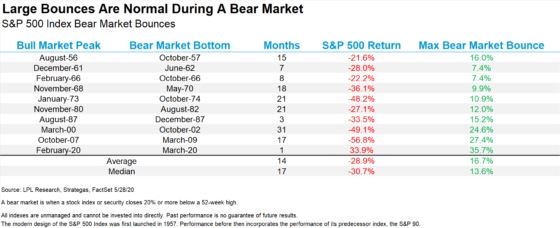

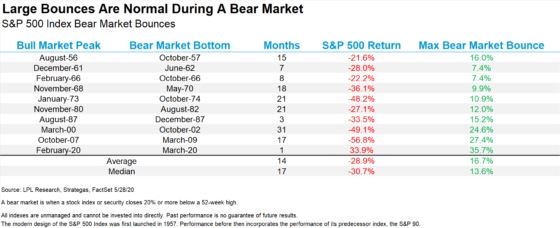

The Dead Cat Bounce Of Investing

The Black Art Of Predicting Stock Market Dead Cat Bounces One More For S P 500 The Market Oracle

What Is Dead Cat Bounce What Does Dead Cat Bounce Mean Dead Cat Bounce Meaning Explanation Youtube

What Is Dead Cat Bounce What Does Dead Cat Bounce Mean Dead Cat Bounce Meaning Explanation Youtube

Technically Speaking Return Of The Bull Or Dead Cat Bounce Seeking Alpha

Technically Speaking Return Of The Bull Or Dead Cat Bounce Seeking Alpha

Homebuilding Ownership And Excess Homes Built Over Time In 2020 Core Inflation Business Investment Credit Market

Homebuilding Ownership And Excess Homes Built Over Time In 2020 Core Inflation Business Investment Credit Market

Usd Comeback Trend Reversal Or Dead Cat Bounce Nordea Asset Management

Usd Comeback Trend Reversal Or Dead Cat Bounce Nordea Asset Management

The Phrase Dead Cat Bounce Meaning And Origin

The Phrase Dead Cat Bounce Meaning And Origin

Dead Cat Bouce Dead Cat Bounce Meaning Cat Bounce

Dead Cat Bouce Dead Cat Bounce Meaning Cat Bounce

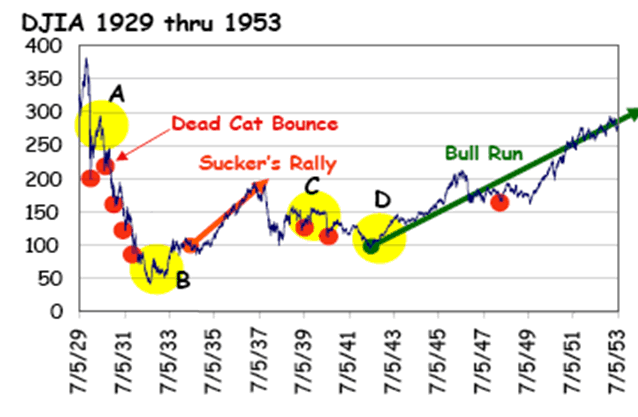

The Stock Market Sucker Rally Dead Cat Is Still Yowling Seeking Alpha

The Stock Market Sucker Rally Dead Cat Is Still Yowling Seeking Alpha

:max_bytes(150000):strip_icc()/Clipboard01-c2c4a2d12c05468184b82358f12a1af5.jpg)

/dotdash_INV_v2_Sucker_Rally_Jan_2021-01-3f8063d7303d4a56b5ebe5eca986faf7.jpg)

Post a Comment for "Dead Cat Bounce Finance Meaning"