No Dead Cat Bounce Meaning

A dead cat might bounce if it is dropped from a great height. A short-lived rally near the bottom of an otherwise persistent decline in the market.

What Is A Dead Cat Bounce How To Trade It

What Is A Dead Cat Bounce How To Trade It

It is a temporary rally in the price of a security or an index after a major correction or downward trend.

No dead cat bounce meaning. Dead-cat bounce definition a temporary recovery in stock prices after a steep decline often resulting from the purchase of securities that have been sold short. Farmers with little storage on the farm find it especially attractive if they do not want to pay commercial storage but also do not want to take the price offered at. The dead cat here is the stockETF.

However after the increase the price drops further breaking its lower bottom. Wall Street expression describing the phenomenon of a stock or share bottoming out to near zero and then recovering with a sharp buying spree from bargain hunters. What is a dead cat bounce A term often used by technical analysts to explain a small brief recovery in the price of a declining stock or the broader market which is then followed by the.

Though it retraced a sizable part of the slump the rally was in the end unable to keep its. It doesnt have the juice to stay up. A temporary recovery in prices following a substantial fall as a result of speculators.

Dating back to 2013 the yellow metal truly plunged in two days like there was no tomorrow. The pattern represents a price pick up in the time of the bearish trend. A temporary increase in the value of shares after there has been a large reduction in their.

In finance a dead cat bounce is a small brief recovery in the price of a declining stock. Your stock prices going up is no more than a dead-cat bounce. Meaning pronunciation translations and examples.

Over the years it has proven to be one of the most reliable and useful marketing strategies for soybeans. Dead cat bounce definition. Dead Cat Bounce is a market jargon for a situation where a security read stock or an index experiences a short-lived burst of upward movement in a largely downward trend.

Dead-cat bounce definition is - a brief and insignificant recovery as of stock prices after a steep decline. What does dead-cat-bounce mean. It has fallen enough it takes a temporary rebound but then because its not actually showing signs of life it falls again.

Even a dead cat will bounce if dropped from a great enough height. This is the rise in popularity that both George Bush and Tony Blair enjoyed following the fall of Baghdad in the Iraqi War. Lets check one of the most memorable dead cat bounces in gold.

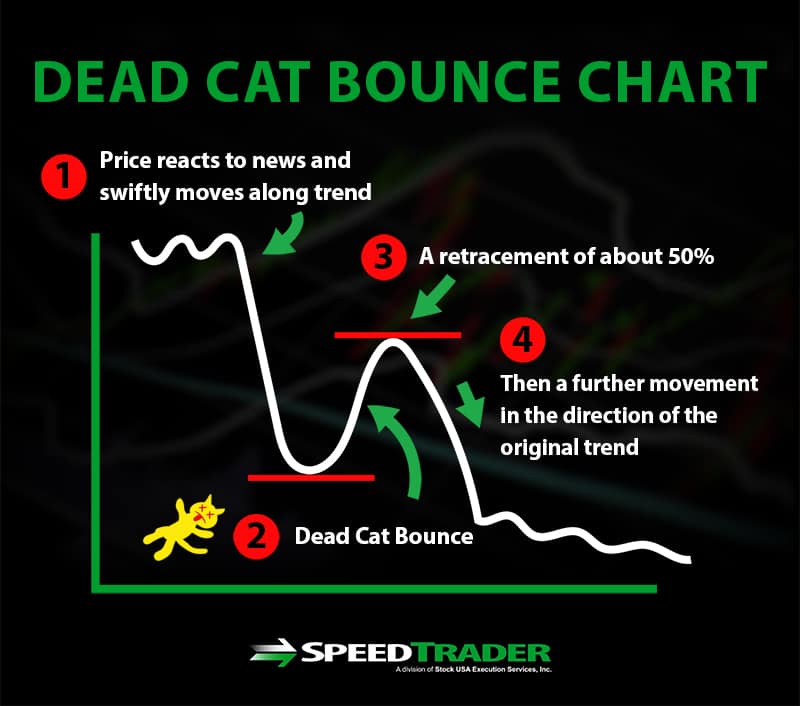

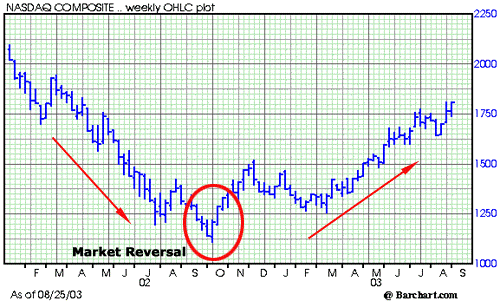

Derived from the idea that even a dead cat will bounce if it falls from a great height the phrase which originated on Wall Street is also popularly applied to any case where a subject experiences a brief resurgence during or following a severe decline. Reasons for a dead cat bounce include a clearing of short positions. The dead cat bounce is a pattern which occurs during bearish price moves.

This is called the dead cat bounce. The fact of it bouncing does not reliably indicate that the cat is alive after all. Soybean harvest is the time when farmers track prices to take advantage of the move I call the Dead Cat Bounce.

The psychology behind the pattern is that the initial short sellers consider that the stock has hit a bottom. The notion being that even a dead cat will bounce if dropped from a high-enough point. The phrase comes from the saying that even a dead cat will bounce when thrown from a high enough height.

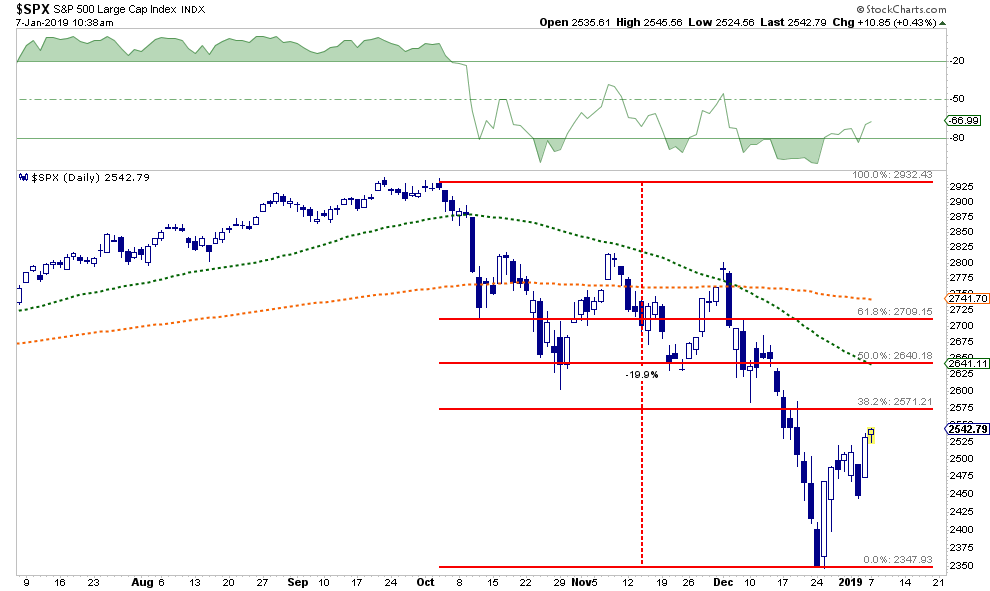

Compared to the slides momentum the recovery took quite some time. Dead Cat Bounce in Gold. A dead cat bounce is a short-term recovery in a declining trend that does not indicate a reversal of the downward trend.

The expression was coined in the late 20th century by Wall Street traders to refer to a situation in which a stock or company on a long-term irrevocable downward trend suddenly shows a small temporary improvement. In a dead-cat bounce the rebound is small and it is only a temporary respite from the selling. A dead cat bounce is a temporary short-lived recovery of asset prices from a prolonged decline or a bear market that is followed by the continuation of the downtrend.

A dead cat bounce happens when a declining cryptocurrency suddenly regains some of its value before it falls even further. The phrase seems to have struck a chord and other bounce phrases have emerged notably Baghdad bounce. Lets examine the differences.

The idea being that even a dead cat will bounce if you drop it from a great height.

Beware The Dead Cat Bounce And Other Stock Market Jargon Nerdwallet

Beware The Dead Cat Bounce And Other Stock Market Jargon Nerdwallet

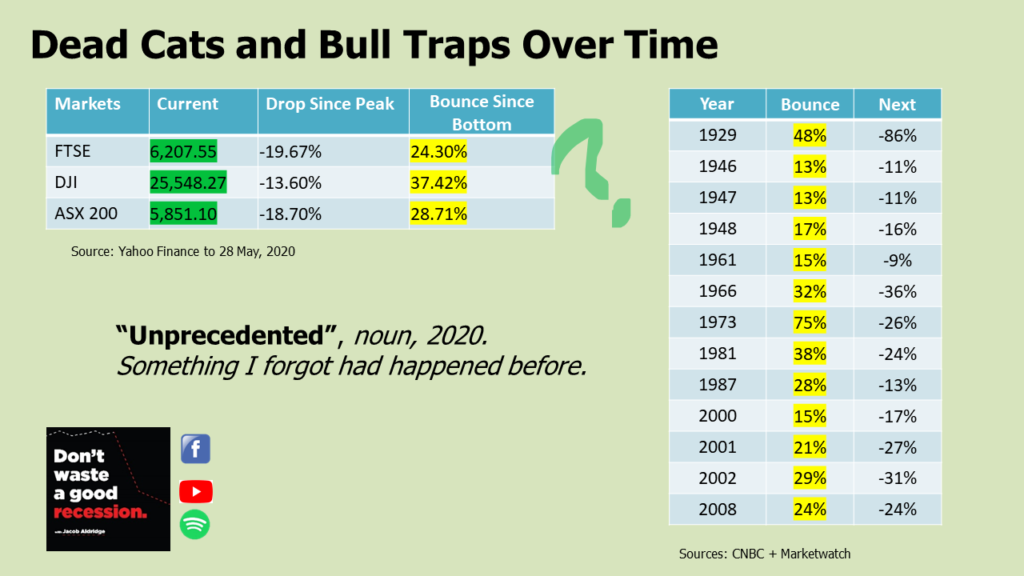

Is This A Dead Cat Bounce Jacob Aldridge

Is This A Dead Cat Bounce Jacob Aldridge

Dead Cat Bouce Dead Cat Bounce Meaning Cat Bounce

Dead Cat Bouce Dead Cat Bounce Meaning Cat Bounce

Falling Knife Definition Example Investinganswers

Falling Knife Definition Example Investinganswers

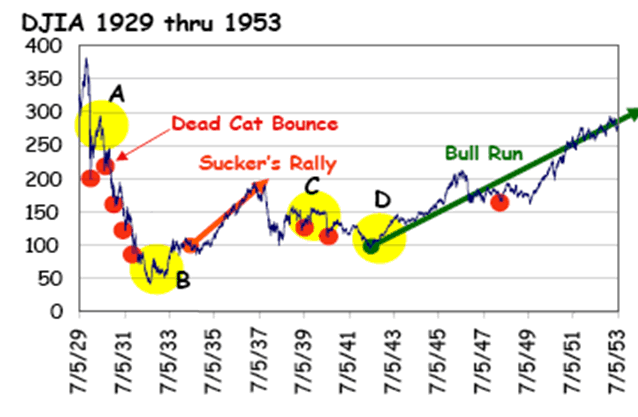

The Stock Market Sucker Rally Dead Cat Is Still Yowling Seeking Alpha

The Stock Market Sucker Rally Dead Cat Is Still Yowling Seeking Alpha

The Dead Cat Bounce Of Investing

Dead Cat Bounce Or Real Rally Investorplace

Dead Cat Bounce Or Real Rally Investorplace

Dead Cat Bounce Definition Example Investinganswers

Dead Cat Bounce Definition Example Investinganswers

Dead Cat Bounces And How To Spot Them

Dead Cat Bounces And How To Spot Them

From The Baghdad Bounce To The Dead Cat Bounce English Language Usage Stack Exchange

From The Baghdad Bounce To The Dead Cat Bounce English Language Usage Stack Exchange

Stock Trading Strategy For Dead Cat Bounce Updated Tradingninvestment

Stock Trading Strategy For Dead Cat Bounce Updated Tradingninvestment

Dead Cat Bounce Definition Forexpedia By Babypips Com

Dead Cat Bounce Definition Forexpedia By Babypips Com

What Is A Dead Cat Bounce Definition Explanation And Trading Guide

What Is A Dead Cat Bounce Definition Explanation And Trading Guide

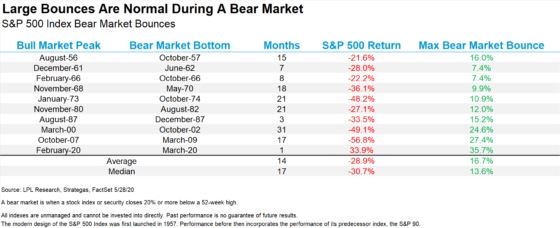

Technically Speaking Return Of The Bull Or Dead Cat Bounce Seeking Alpha

Technically Speaking Return Of The Bull Or Dead Cat Bounce Seeking Alpha

Dead Cat Bounce What Is It How Can You Profit From It

Dead Cat Bounce What Is It How Can You Profit From It

/dotdash_INV_v2_Sucker_Rally_Jan_2021-01-3f8063d7303d4a56b5ebe5eca986faf7.jpg)

Post a Comment for "No Dead Cat Bounce Meaning"