Why Is It Called A Dead Cat Bounce

When the stock is always volatile within a continued period of downside this gap is over 5. The rally is considered a dead cat bounce if its short-lived and the market continues to fall again in week 12.

Dead Cat Bounces And How To Spot Them

Dead Cat Bounces And How To Spot Them

Whether its stock CFD or forex trading charts can be used to identify chart patterns and study the markets.

Why is it called a dead cat bounce. Origins of Dead Cat Bounce. From a technical analysis standpoint a dead cat bounce is called when the price drops below its prior low or trend low. Most of the time waffling causes a dead cat bounce.

But when the stock isnt volatile this gap of 5 must be taken into consideration. The term dead cat bounce comes from an old saying that even a dead cat will bounce if you drop it far enough. A dead cat bounce is a temporary short-lived recovery of asset prices from a prolonged decline or a bear market that is followed by the continuation of the downtrend.

This is called the dead cat bounce. This Pattern is largely considered an indicator of continuing market weakness. Even a dead cat will bounce if dropped from a great enough height.

Watch for the price to rally back into the vicinity of the open price. Commentary Once again we see the situation whereby one day the markets drop and the next day they rise. A website of bouncing cats.

Posted on 05022021 by admin. One of these patterns is called a dead cat bounce and it entails the correction of a bearish trend in price action. Welcome to our world were so glad you could make it.

Reasons for a dead cat bounce include a clearing of short positions. It is the part and parcel of this game called Day Trading. The idea here is that even something worthless can sometimes seem valuable under the right conditions.

Dead cats dont jump but they can bounce. If we are in loss today we can be in profit tomorrow. During a long downward slide some investors may think that the market or a particular security has bottomed out.

A Dead Cat Bounce is a technical trading pattern thats unique to stock forex and commodities bear markets whereby a swift drop is followed by a small short-lived recovery before another brutal drop takes over. A dead cat bounce is a short-term recovery in a declining trend that does not indicate a reversal of the downward trend. A dead cat bounce is a phenomenon that occurs when a stock gap is lower by a remarkable percentage.

It is in the same vein as saying that even a stopped clock is right twice a day. A dead-cat-bounce is when the next low after a rally is lower than the preceding low note mini-rallies less than 25 of the previous drop that then drop more than 10 are not. A dead cat bounce is when the price gaps down 5 or more continues to decline after the open but then has a rally.

What Is a Dead Cat Bounce. This is once again a guide. This is the rise in popularity that both George Bush and Tony Blair enjoyed following the fall of Baghdad in the Iraqi War.

Noun dead cat bounce plural dead cat bounces trading idiomatic A temporary recovery in the price of a financial instrument which has fallen rapidly and is expected to fall further in the long run. A dead cat bounce occurs when for example a stock is continuing in a strong downtrend. This phenomenon was called a dead cat bounce going from the adage that even a dead cat will bounce It was undoubtedly a catchy phrase so it didnt take long for the concept to catch on.

For example 5 represents that phenomenon. The phrase seems to have struck a chord and other bounce phrases have emerged notably Baghdad bounce. The idea being that even a dead cat will bounce if you drop it from a great height.

Derived from the idea that even a dead cat will bounce if it falls from a great height 2 the phrase which originated on Wall Street is also popularly applied to any case where a subject experiences a brief resurgence during or following a severe decline. Some cats are bouncier than others so that means more force more bounceUse a gentler touch if youre losing cats. It should not be bothering us so much.

A dead cat bounce is known as a continuation pattern because although the bounce may initially appear to signal a trend reversal it is followed by a continuation of the downtrend. In finance a dead cat bounce is a small brief recovery in the price of a declining stock. We call this a Dead Cat Bounce as the Dow dropped over 600 points on Friday but did not even.

Table of Contents show. Dead Cat Bounce. How to Trade the Dead Cat Bounce.

The area around the open price is likely to be a resistance level. Now the dead cat bounce can refer to this sort of action in stocks forex commodities and even beyond the financial sphere.

Trading Chart Of The Day Trading Charts Chart Position Trading

Trading Chart Of The Day Trading Charts Chart Position Trading

Pin By Forex Trading Forex Signal On Forex Trading Trading Strategies Forex Fibonacci

Pin By Forex Trading Forex Signal On Forex Trading Trading Strategies Forex Fibonacci

Dead Cat Bounce Options Money Maker

Dead Cat Bounce Options Money Maker

From The Baghdad Bounce To The Dead Cat Bounce English Language Usage Stack Exchange

From The Baghdad Bounce To The Dead Cat Bounce English Language Usage Stack Exchange

Dead Cat Bounce Forex Trading Quotes Trading Charts Trading Quotes

Dead Cat Bounce Forex Trading Quotes Trading Charts Trading Quotes

Dow Jones Is In The Dead Cat Bounce Stage I Was Saying This For Years It Is Just A Bubble Going To 0 In Next 24 Hours Go Out As Long As

Dow Jones Is In The Dead Cat Bounce Stage I Was Saying This For Years It Is Just A Bubble Going To 0 In Next 24 Hours Go Out As Long As

Pin On Retirement Account Protection

Pin On Retirement Account Protection

The Dead Cat Done Bounced Seeking Alpha

The Dead Cat Done Bounced Seeking Alpha

101 Uses For A Dead Cat Book Humor Jokes And Riddles Cat Books

101 Uses For A Dead Cat Book Humor Jokes And Riddles Cat Books

How To Spot A Dead Cat Bounce On Any Falling Stock

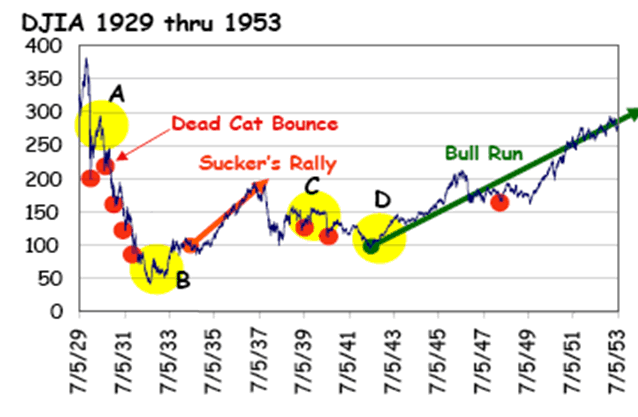

The Stock Market Sucker Rally Dead Cat Is Still Yowling Seeking Alpha

The Stock Market Sucker Rally Dead Cat Is Still Yowling Seeking Alpha

The Phrase Dead Cat Bounce Meaning And Origin

The Phrase Dead Cat Bounce Meaning And Origin

Pin On Religious Art Saints And Hero S Teachings

Pin On Religious Art Saints And Hero S Teachings

What Is A Dead Cat Bounce Youtube

What Is A Dead Cat Bounce Youtube

Dead Cat Bounce Success Financial Freedom

/suckerrallyexampleinSP500-6452dffe01514175b8e33f932b2539c4.jpg)

Post a Comment for "Why Is It Called A Dead Cat Bounce"